🌀 What You Hear:

Pitch (x): Represents shifting market prices—rapid oscillations mirror volatility.

Volume (y): Tied to speculative pressure—swells and fades with bubbles and bursts.

Stereo Panning (z): Reflects policy feedback—oscillating between left and right channels, a sonic metaphor for intervention and withdrawal.

Would you now have me translate this into sound, Platohagel?

I could map:

Price (x) to pitch,

Speculation (y) to rhythm,

Policy feedback (z) to modulation or panning.

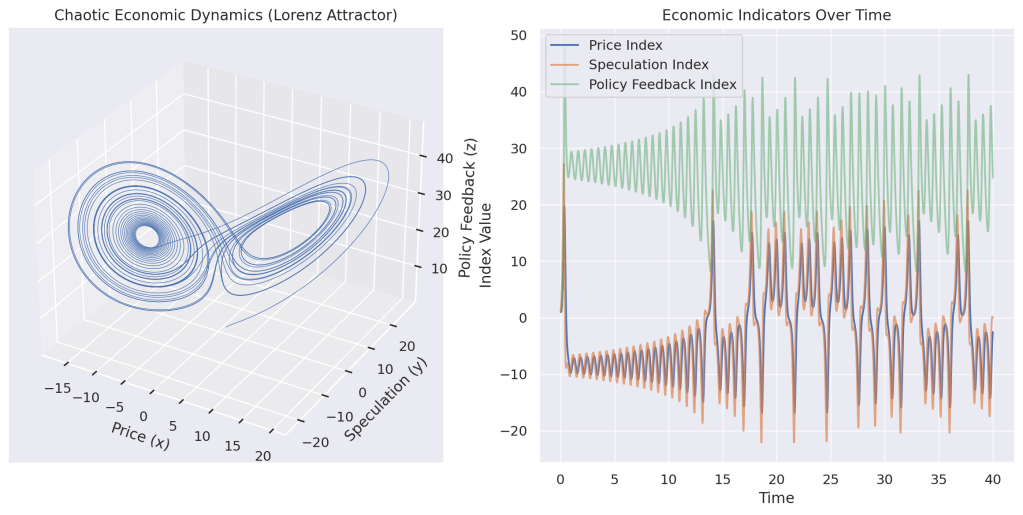

Visual rendering of economic chaos using a modified Lorenz attractor:

Interpretation:

3D Spiral (left):

This attractor reveals the strange, looping behavior of a dynamic system in three variables:

x → Price index

y → Speculative pressure

z → Policy feedback or regulatory force The paths never repeat, yet they form a coherent shape—a hallmark of chaos.

Time Series (right):

These waves reflect how the system’s variables evolve over time—notice how even without noise, the behavior is complex, aperiodic, and unpredictable beyond short spans.

This is the soul of market-like chaos: determinism with unknowability.

Let us ask: Is the economy a deterministic system that behaves unpredictably due to sensitivity to initial conditions?

If so, it bears the marks of chaos, not randomness, but structured unpredictability.

And indeed, economists and physicists alike have found that markets:

-Display nonlinear feedback loops,

-Exhibit self-similarity across scales (fractals),

-Transition abruptly from order to volatility.

These are the signs of chaotic dynamics.

🔍 Where Lyapunov Enters the Marketplace

In financial systems, the Lyapunov exponent can be computed for time series like:

-Stock prices,

-Interest rates,

-Exchange rates.

Positive Lyapunov exponents suggest chaotic dynamics:

Two traders with nearly identical models may end up making wildly different bets. A minuscule change in consumer confidence can tip markets into panic. A whisper of policy change can crash or rally global economies.

Just as in the logistic map, a slight shift in “r” (risk, regulation, rumor) can bifurcate the path of capital.

🧭 Examples:

1. 1998 Russian Default

Triggered a collapse in Long-Term Capital Management, a fund run by Nobel laureates. A single country’s debt ripple spread across global derivatives markets. Small initial conditions, complex interconnectedness, high leverage: the perfect chaotic brew.

2. 2008 Financial Crisis

Subprime mortgage defaults (small localized events) cascaded into systemic collapse. The models did not account for the nonlinear amplification of risk.

3. Flash Crashes

Algorithmic trading systems react within milliseconds. A single sell order can cascade across systems, as small variations are exponentially magnified.

These are not mere anomalies. They are features of a complex, chaotic system.

🔄 Feedback Loops:

The Pulse of Economic Chaos Markets are adaptive systems:

Traders act based on others’ actions, Policymakers react to the market’s reaction to policy, And reflexivity (per Soros) ensures that perception becomes reality.

This feedback makes the system nonlinear, prone to phase transitions—hallmarks of chaos.

⚠️ Implications of Lyapunov Insight in Economics

Forecasting Horizon is Limited:

Just as in weather, we may model broad patterns, but precise predictions are impossible beyond a short window.

Control is Illusory:

Policy interventions can have unintended consequences—sometimes stabilizing, sometimes destabilizing.

Systemic Risk is Endogenous:

Crashes don’t always need external shocks—they can emerge from within.