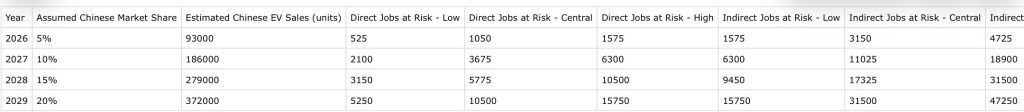

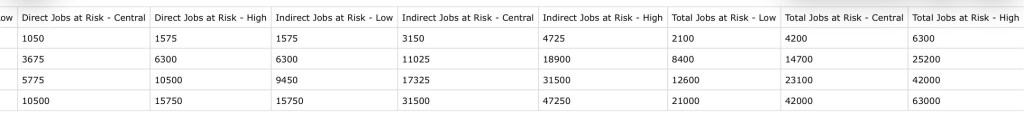

It uses a central ramp where Chinese EV share = 5%, 10%, 15%, 20% for 2026–2029 and shows low/central/high risk bands for direct and indirect jobs plus totals.

Platohagel — if Canada removed tariffs on Chinese-electric vehicles (EVs), several significant effects would be likely for the Canadian EV/automotive industry. I’ll step through the major levers and potential outcomes, as Socrates might.

Key levers

-Import competition: Lowering or removing tariffs means more Chinese-brand EVs (which often have lower cost structures) could enter the Canadian market more readily. For example, Canada currently has a 100 % tariff on Chinese EVs.

-Domestic manufacturer & parts supplier impact: Canada has a domestic automotive ecosystem (vehicles & parts) deeply linked to the U.S. as well.

-Consumer pricing / demand: With cheaper imported EVs, consumer choices and price dynamics change.

-Trade / supply chain effects: Changing tariffs alters trade flows, sourcing, scale, cross-border integration.

-Strategic/industrial policy and climate transition: The role of EVs in decarbonization, domestic manufacturing, technological capability all come into play. For instance, some analysts say the current tariff regime slows down EV adoption in Canada.

Likely effects

Here are probable outcomes from removing tariffs:

Positive (for consumers & market growth)

-Lower vehicle costs for consumers: More Chinese EV models at competitive pricing would likely push market prices down or at least create more choice.

-Increased EV adoption: With cheaper options, some buyers who were priced-out may adopt EVs. That supports Canada’s climate/EV goals (assuming access to charging, infrastructure, etc.).

-Accelerated innovation/technology diffusion: Access to Chinese firms’ cost structures, designs could spur competitive pressure on domestic players to improve.

*Some commentary suggests Canada could benefit from partnerships with Chinese firms in batteries/components. Expansion of importers/distributors, possibly new business models.

Negative (for domestic production/parts suppliers and trade)

-Downward pressure on domestic vehicle manufacturing: If cheaper import EVs flood the market, Canadian‐based production (or parts suppliers) might lose market share, reduce volumes.

-Risk to parts suppliers: Many parts are tied to volume builds; if manufacturing shrinks, suppliers suffer. Analysts say Canada’s auto industry (150k direct jobs, 500k indirect) may be exposed.

-Dependence on imports: Domestic capability might erode if the local industry cannot compete, leading to more imports rather than local builds. One analysis says the tariff wall currently deepens dependence on the U.S.; removing tariffs may shift dependence toward

-China. Trade/retaliation risk: For example, removal could provoke China or other countries to demand concessions, or disrupt existing trade protections. Already China has responded to Canada’s EV tariff with tariffs on Canadian agricultural products.

Mixed / conditional effects

-Domestic manufacturer strategy: Canadian firms may pivot to premium segments, niche EVs, or to parts rather than full vehicles, depending on competitive pressure.

-Investment & supply chain shifts: The removal of tariffs might encourage Chinese automakers to access the Canadian market (maybe through imports initially). But manufacturing inside Canada would still depend on labour, incentives, supply chain—so domestic production might not automatically follow.

-Infrastructure and ecosystem effects: If EV adoption grows, charging infrastructure, grid demand, battery recycling, local supply chains could scale. But if imports dominate, the local value-added may remain low.

What this means for Canada’s industry in a summary

Canada will likely see more competition, lower consumer prices, faster adoption of EVs. Domestic production (vehicles/parts) will face stronger pressure to differentiate, cut costs, or focus on segments where they can compete. Parts and suppliers could face downside risk unless they adapt to new models (e.g., high-value EV components, battery modules) or integrate with global supply chains.

Canada’s strategic posture changes: from protection toward open competition, which may expose manufacturing jobs but also open new opportunities if leveraged (e.g., battery R&D, advanced manufacturing). The interplay with the U.S. market: Because Canada’s auto production is deeply linked to the U.S., decisions will also hinge on U.S. tariffs, regulations, and content rules. Canada cannot assume a fully independent path.

Risks and caveats

If import Chinese EVs dominate the market without local supply chain participation, Canada could become simply an importer rather than a producer, resulting in lost industrial capability.

-Quality, standards, service, warranty and after-sales issues: New entrants may have different service networks; this affects consumer trust and cost of ownership. The speed and scale of impact depend on which Chinese firms choose to import, how Canadian consumers respond, and how domestic firms adjust. Government policy may still impose rules (local content, incentives) which affect how competitive imported EVs are.

-Trade dynamics: Removing tariffs may bring benefits, but could also trigger retaliation or shift Canada’s bargaining power in other sectors (e.g., agriculture).

What I’d watch for

Changes in market share of Chinese-brand EVs in Canada (once tariffs shift). Impact on Canadian-based EV and parts manufacturing volumes. Service/after-sales networks for imported Chinese EVs and consumer confidence.

-Policy responses: e.g., incentives for domestic manufacturing, local-content rules, changes in supply-chain subsidies.

-Price movements for EVs in Canada: pre- and post-tariff removal. Whether Chinese car-makers set up production or assembly in Canada or North America to mitigate logistics/tariffs.

————————

I modeled three scenarios and the most likely impacts now.

Key facts used

• Canada imposed a 100% tariff on Chinese EV imports in Oct 2024.

• Canada sold ≈1.86 million new vehicles in 2024.

• ZEV share of new registrations was roughly 10–15% in recent data (BEV share ≈6–12% depending on quarter).

• Canada produced ~1.29 million vehicles in 2024 and exports most of them; domestic consumption of Canada-made vehicles is small (~9–10%).

• Auto manufacturing accounts for ~105k–125k direct jobs in Canada and ~600k direct+indirect jobs in the broader auto ecosystem.

⸻

Common assumptions for all scenarios

1. Tariff removal is immediate and applies only to fully built Chinese imports.

2. Importers price competitively and pass a large share of cost savings to consumers.

3. Supply chain, certification, and dealer/service networks scale over 1–4 years.

4. No immediate Canadian production by Chinese OEMs (assembly/investment is a 3–7 year decision).

⸻

Scenario A — Conservative (low Chinese entry)

• Assumption: Chinese brands capture 5% of new-vehicle sales within 2 years.

• Numbers: 1.86M annual sales → ~93,000 Chinese EVs/year.

• Retail price impact: average EV prices fall 5–10% in affected segments.

• EV market effect: ZEV share rises modestly (+1–3 percentage points) because cheaper models convert some buyers.

• Domestic industry impact: small decline in domestic-brand volume in Canada (≈2–4% of domestic sales). Given Canada exports most production, national production drops <2%.

• Jobs: limited direct manufacturing job loss; 0.5–1.5% of auto-manufacturing jobs at risk in 2 years (≈500–2,000 jobs), greater risk in dealer and parts segments dependent on local volumes.

• Net: consumer welfare increases; limited structural harm to domestic manufacturing if policy mitigations exist.

⸻

Scenario B — Moderate (likely / central case)

• Assumption: Chinese brands capture 10–15% of new-vehicle sales over 2–4 years.

• Numbers: 1.86M sales → 186,000–279,000 Chinese EVs/year.

• Retail price impact: mainstream EV prices in Canada fall 10–20% in affected segments. Domestic OEMs cut prices or shift models upward.

• EV market effect: overall ZEV share increases by 2–6 percentage points as price elasticity brings new buyers.

• Domestic industry impact: domestic sales lose 5–10% of their Canada market volume; because Canada’s assembly is export-heavy, total production could fall 2–5% unless OEMs reallocate output to export markets. Parts suppliers see meaningful revenue pressure.

• Jobs: 2–6% risk to direct auto manufacturing and supplier roles if OEMs reduce Canadian content or shift sourcing (≈2,000–7,500 direct jobs; larger indirect effects across 20k+ jobs).

• Net: faster EV adoption and lower consumer costs but real disruption to parts suppliers, dealers, and some assembly roles unless offset by new investment (batteries, high-value components).

⸻

Scenario C — Aggressive (high Chinese entry / rapid disruption)

• Assumption: Chinese brands capture 20%+ of new-vehicle sales within 3 years.

• Numbers: 1.86M sales → ≈372,000+ Chinese EVs/year.

• Retail price impact: downward pressure on EV prices of 15–30% across many segments. Non-price competitive domestic models are shelved.

• EV market effect: ZEV share jumps significantly, possibly +5–10 percentage points.

• Domestic industry impact: meaningful domestic market share loss leads OEMs to cut Canada-market allocations or shift production lines. Total vehicle production could fall 5–10% unless offset by export demand or new investments. Many tier-2/3 parts suppliers face large revenue declines.

• Jobs: 5–15% of direct manufacturing & supplier jobs at risk (≈5,000–18,000 direct jobs) plus larger dealer/service job losses.

• Net: strong consumer benefits and faster EV fleet turnover. Significant industrial dislocation unless government uses industrial policy to capture battery/EV supply chain value domestically.

⸻

Secondary, non-quantified effects to expect

• After-sales and warranty networks will determine consumer confidence and total cost of ownership. Poor networks reduce uptake despite low prices.

• Investment responses. Chinese OEMs may initially import. If market proves lucrative they may consider local assembly later. That could restore some jobs but mostly in distribution and light assembly unless major battery/parts investments arrive.

• Policy reactions. Canada could pair tariff removal with incentives for local battery plants, R&D, or local content rules to capture value. Absent policy, imports dominate value capture abroad.

• Trade politics. Tariff removal could change retaliatory dynamics across sectors.

⸻

Quick decision levers for policymakers or industry

1. Combine tariff removal with targeted industrial incentives for battery gigafactories and high-value EV components.

2. Fast-track certification and parts-supplier integration programs so local suppliers can bid into Chinese OEM supply chains.

3. Support dealer/service network requirements (warranty, parts depot rules) to protect consumers and jobs.

4. Monitor price, market share, and jobs quarterly and be ready with adjustment funds for re-skilling.

⸻