Stress test: a hostile or retreating U.S. policy shift

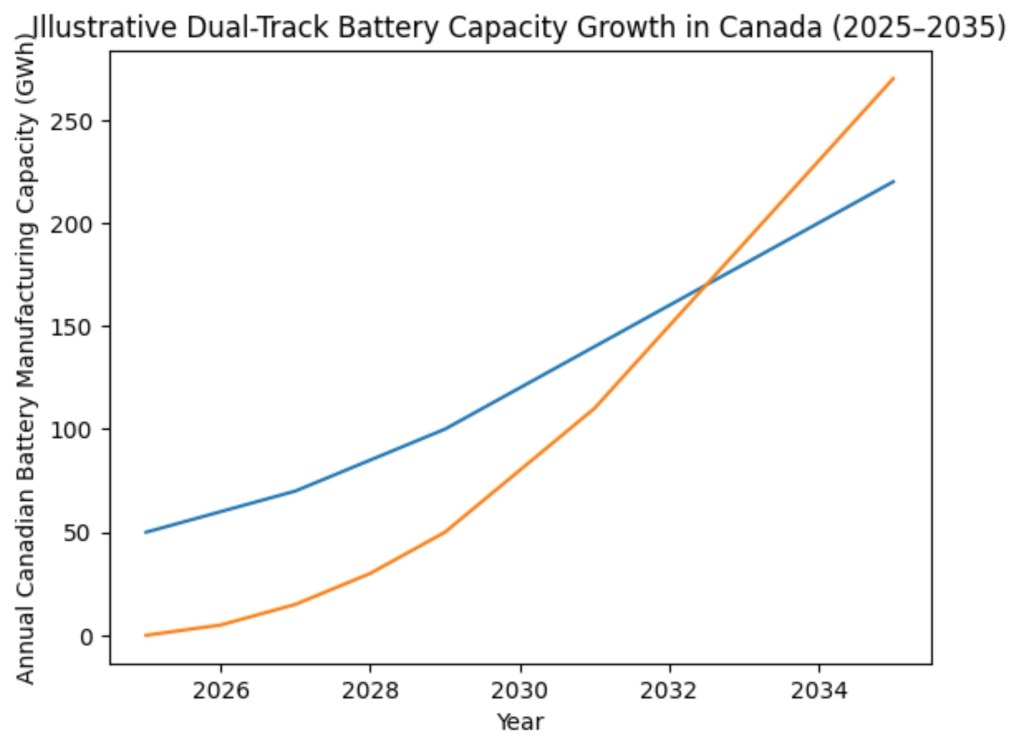

The chart shows illustrative annual manufacturing capacity, not predictions.

Blue line (Lithium): Steady, disciplined growth. Reflects EV-linked expansion. Tops out around ~220 GWh by 2035.

Orange line (Sodium): Slow start (policy hesitation phase). Rapid acceleration once standards and procurement align. Surpasses lithium in total capacity by early 2030s.

This crossing point is not symbolic.

It marks the moment when endurance overtakes velocity.

I. A dual-track lithium–sodium policy roadmap (2025–2035)

Phase 1: Anchoring credibility (2025–2028)

Lithium (market-facing)

• Consolidate and fully ramp NextStar and at least one additional cell facility.

• Prioritize EV propulsion, alliance compliance (IRA-equivalent rules), and export eligibility.

• Public role: incentives, cathode supply agreements, workforce training.

Sodium (sovereignty-facing)

• Pilot sodium-ion manufacturing for stationary storage only.

• Use Crown utilities and federal procurement as first buyers.

• Target: grid firming, remote communities, industrial backup.

Logic:

Lithium secures Canada’s seat at the table.

Sodium quietly builds independence without triggering trade alarms.

⸻

Phase 2: Structural differentiation (2028–2031)

Lithium

• Gradual capacity expansion tied strictly to confirmed EV demand.

• No overbuild; avoid becoming a stranded-asset jurisdiction.

• Begin selective domestic cathode and refining capability.

Sodium

• Scale sodium plants aggressively.

• Mandate sodium eligibility in provincial grid tenders.

• Standardize sodium storage codes, safety, and warranties.

Logic:

Lithium remains competitive but exposed.

Sodium becomes boring, ubiquitous, and indispensable.

⸻

Phase 3: System leadership (2031–2035)

Lithium

• Stabilize around mobility, heavy transport, and premium EV segments.

• Canada remains a trusted node, not a global hegemon.

Sodium

• Sodium capacity surpasses lithium in energy throughput, not prestige.

• Canada exports grid resilience, not vehicles.

• Sodium becomes embedded infrastructure, like transformers or substations.

Logic:

Markets fluctuate. Systems endure.

⸻

II. Indigenous equity as structure, not concession

This is not about consultation alone. It is about ownership geometry.

Lithium path (constrained)

• Extraction-heavy.

• Long permitting timelines.

• High environmental and legal risk.

• Indigenous participation tends to be negotiated around the project.

Sodium path (transformative)

• Processing- and manufacturing-heavy.

• Modular facilities.

• Compatible with clean power zones.

• Enables equity-first design, not mitigation.

Structural mechanisms Canada should embed:

• Minimum Indigenous equity stakes (not royalties) in sodium facilities.

• Long-term offtake agreements with Indigenous utilities.

• Training pipelines tied to operational control, not just employment.

Result:

Lithium requires consent.

Sodium enables co-authorship.

This is the difference between permission and partnership.

⸻

Assume the following shock:

• U.S. weakens EV mandates or IRA support.

• Protectionist instincts reassert.

• Cross-border certainty declines.

Lithium under this scenario

• Demand volatility increases.

• Overcapacity risk rises.

• Canada becomes vulnerable to U.S. political cycles.

Sodium under this scenario

• Domestic grid needs remain.

• Electrification does not reverse.

• Utilities still require storage.

Thus:

• Lithium is politically exposed.

• Sodium is politically agnostic.

A nation that ties sovereignty to lithium alone ties it to foreign elections